Content

This means that the company is using its debt to finance its operations. A high degree of leverage can lead to greater profits in good times but can also lead to greater. Operating leverage results from the presence of fixed operating costs in a firm’s income stream. The extent of the presence of fixed operating costs in a firm’s income stream is measured by the degree of operating leverage .

The output of the DFL formula can be read as “for each 1% change in operating income, net income will change by X %”. The degree of combined leverage is the degree to which a company’s operations are financed by borrowed funds.

Degree of Financial Leverage – DFL

Finally, the DFL Formula can be calculated by dividing the percentage change in net income by the percentage change in EBIT , as shown above. Therefore, companies must be cautious when adding debt into their capital structure, as both the favorable and unfavorable effects are magnified.

While calculating the DFL, we usually ignore the taxes paid. This is mainly because; the taxes are usually calculated as a constant percentage and not as a constant dollar amount. And since the percentage of taxes remains the same, it does not affect the degree of financial leverage. So, we can see that the degree of leverage is different at different levels of quantity. As there is a decrease in the quantity of goods sold, the burden of fixed cost increases and thus there is an increase in the degrees of operating leverage. And the opposite is the case with the increase in the quantity of goods. Leverage is the use of fixed cost in the capital structure of the company.

DFL Formula Breakdown (Step-by-Step)

Learn accounting fundamentals and how to read financial statements with CFI’s free online accounting classes. Get instant access to video lessons taught by experienced investment bankers. Learn financial statement modeling, DCF, M&A, LBO, Comps and Excel shortcuts.

A high degree of operating leverage means that a company is riskier, as it is more reliant on its debt to finance its operations. A low degree of operating leverage means that a company is less risky, as it is not using much debt to finance its operations. This total or combined leverage results from the presence of both fixed operating and financial costs in a firm’s income stream. Combined leverage is measured by the degree of combined leverage https://business-accounting.net/ . Since DFL helps find the changes in the net income based on changes in its operating income and capital structure, it is very useful for future modeling. For example, if a firm decides to use the DFL to take on more debt in the future, it would increase its interest expenses. The degree of operating leverage or DOL refers to the percentage change in the operating profits as a result of a percentage change in the quantity of goods sold.

What is Leverage?

While all three ratios measure the same thing, they each have different implications for a company’s risk and return. In addition, the degree of combined leverage only provides information about potential risks; it does not predict whether a company will actually experience financial distress.

- It helps an entity to assess the debt or leverage it can manage comfortably and without affecting other operating parameters.

- Leverage in finance is the effect of borrowing on financial returns.

- An increase in depreciation expense will lead to a taxable income.

- Interest expense and taxes to the net income, all of which are line items from the income statement.

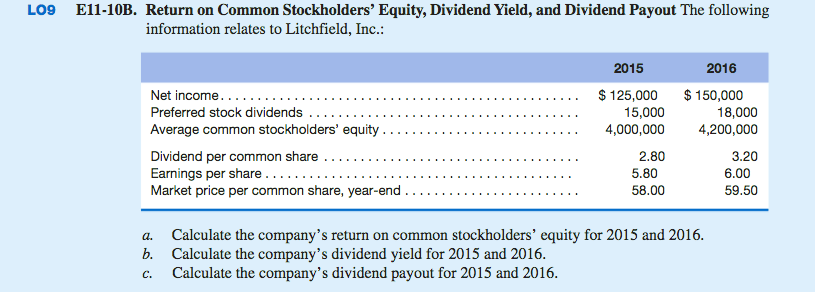

A firm has a profit margin of 4.5% and an equity multiplier of 2.6. Its sales are $420 million, and it has total assets of $168 million. If a company’s operating margin increases but its profit margin decreases, it could mean that the company paid more in interest or taxes.

Calculation of Degree of Combined Leverage

As such, the degree of combined leverage is an important factor to consider when assessing a company’s creditworthiness. Two companies have the same EBIT of $3,000,000 but different capital structure. Company Y is mostly focused on equity financing using both common and preferred equity. Its preferred dividend payment is $150,000, and the interest payment is $250,000. By contrast, Company Z tends to use debt financing and has only common equity.

The investment strategy of leverage is based on borrowing money in order to enhance the potential return on investment. It’s possible to use it in business, as well as professional trading and even to finance a home. Financial leverage also refers to the amount of debt a firm uses to acquire an asset. DFL helps us Degree Of Financial Leverage Dfl to understand how changes in a company’s operating income translate into changes in net income after interest and tax expenses have been factored in. The third formula to calculated DFL compares the company at two points in time and the change in net income that took place based on the changes in operating income.